|

|

Net Present Value(NPV)

Net Present Value

LEARNING OBJECTIVE

- Evaluate investments using the net present value (NPV) approach.

Question: Now that we have the tools to calculate the present value of future cash flows, we can use this information to make decisions about long-term investment opportunities. How does this information help companies to evaluate long-term investments?

Answer: The net present value (NPV) method of evaluating investments adds the present value of all cash inflows and subtracts the present value of all cash outflows. The term discounted cash flows is also used to describe the NPV method.

In the previous section, we described how to find the present value of a cash flow. The term net in net present value means to combine the present value of all cash flows related to an investment (both positive and negative).

Recall the problem facing Jackson’s Quality Copies at the beginning of the chapter. The company’s president and owner, Julie Jackson, would like to purchase a new copy machine.

Julie feels the investment is worthwhile because the cash inflows over the copier’s life total $82,000, and the cash outflows total $57,000, resulting in net cash inflows of $25,000 (= $82,000 – $57,000).

However, this approach ignores the timing of the cash flows. We know from the previous section that the further into the future the cash flows occur, the lower the value in today’s dollars.

Question: How do managers adjust for the timing differences related to future cash flows?

Answer: Most managers use the NPV approach. This approach requires three steps to evaluate an investment:

Step 1. Identify the amount and timing of the cash flows required over the life of the investment.

Step 2. Establish an appropriate interest rate to be used for evaluating the investment, typically called the

required rate of return. (This rate is also called the discount rate or hurdle rate.)

Step 3. Calculate and evaluate the NPV of the investment.

Let’s use Jackson’s Quality Copies as an example to see how this process works.

Step 1. Identify the amount and timing of the cash flows required over the life of the investment.

Question: What are the cash flows associated with the copy machine that Jackson’s Quality Copies would like to buy?

Answer: Jackson’s Quality Copies will pay $50,000 for the new copier, which is expected to last 7 years. Annual maintenance costs will total $1,000 a year, labor cost savings will total $11,000 a year, and the company will sell the copier for $5,000 at the end of 7 years.

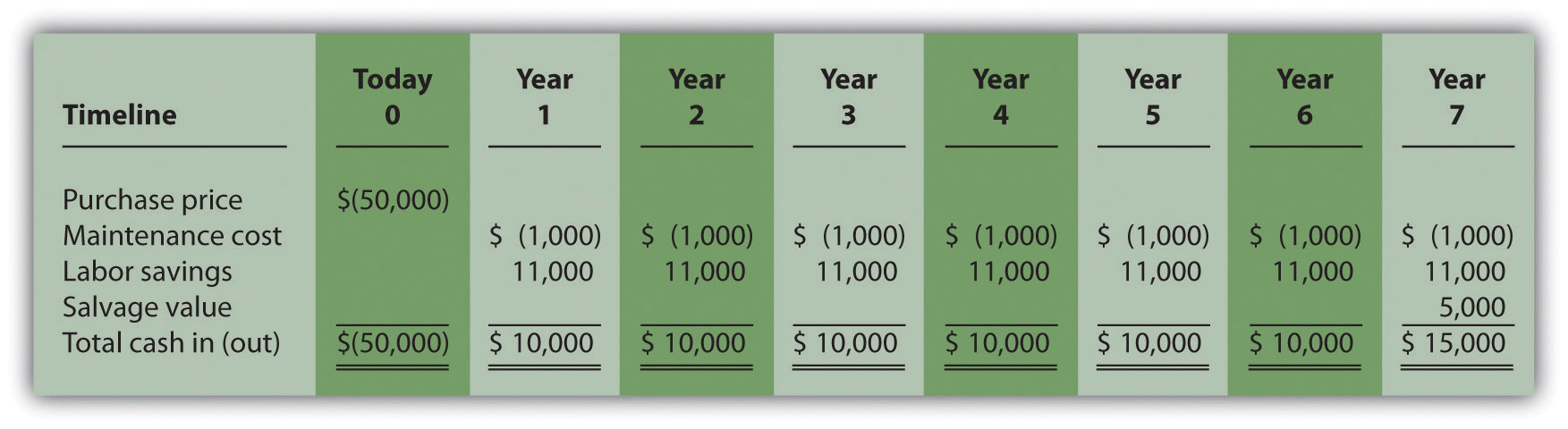

Figure 8.1 "Cash Flows for Copy Machine Investment by Jackson’s Quality Copies"

summarizes the cash flows related to this investment. Amounts in parentheses are cash outflows.

All other amounts are cash inflows.

Figure 8.1 Cash Flows for Copy Machine Investment by Jackson’s Quality Copies

Step 2. Establish an appropriate interest rate to be used for evaluating the investment.

Question: How do managers establish the interest rate to be used for evaluating an investment?

Answer: Although managers often estimate the interest rate, this estimate is typically based on the organization’s cost of capital. The [url=]cost of capital[/url] is the weighted average costs associated with debt and equity used to fund long-term investments. The cost of debt is simply the interest rate associated with the debt (e.g., interest for bank loans or bonds issued). The cost of equity is more difficult to determine and represents the return required by owners of the organization. The weighted average of these two sources of capital represents the cost of capital (finance textbooks address the complexities of this calculation in more detail).

The general rule is the higher the risk of the investment, the higher the required rate of return (assume required rate of return is synonymous with interest rate for the purpose of calculating the NPV).

A firm evaluating a long-term investment with risk similar to the firm’s average risk will typically use the cost of capital.

However, if a long-term investment carries higher than average risk for the firm,

the firm will use a required rate of return higher than the cost of capital.

The accountant at Jackson’s Quality Copies, Mike Haley, has established the cost of capital for the firm at 10 percent.

Since the proposed purchase of a copy machine is of average risk to the company,

Mike will use 10 percent as the required rate of return.

Step 3. Calculate and evaluate the NPV of the investment.

Question: How do managers calculate the NPV of an investment?

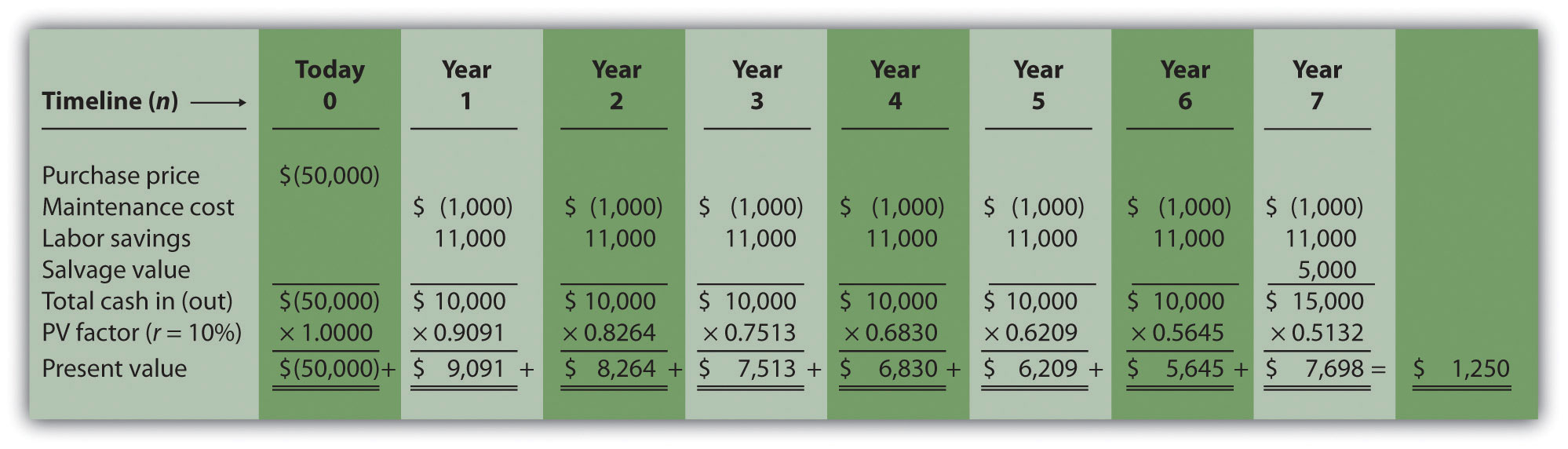

Answer: Figure 8.2 "NPV Calculation for Copy Machine Investment by Jackson’s Quality Copies"

shows the NPV calculation for Jackson’s Quality Copies.

Examine this table carefully.

The cash flows come from Figure 8.1 "Cash Flows for Copy Machine Investment by Jackson’s Quality Copies".

The present value factors come from Figure 8.9 "Present Value of $1 Received at the End of " in the appendix (r = 10 percent; n = year).

The bottom row, labeled present value is calculated by multiplying the total cash in (out) × present value factor, and it represents total cash flows for each time period in today’s dollars.

The bottom right of Figure 8.2 "NPV Calculation for Copy Machine Investment by Jackson’s Quality Copies"

shows the NPV for the investment, which is the sum of the bottom row labeled present value.

Figure 8.2 NPV Calculation for Copy Machine Investment by Jackson’s Quality Copies

The NPV is $1,250. Because NPV is > 0, accept the investment. (The investment provides a return greater than 10 percent.)

https://saylordotorg.github.io/text_managerial-accounting/s12-02-net-present-value.html

|

凡事唯有投入,結果才能深入; 凡事唯有付出,結果才能傑出;

凡事唯有磨鍊,結果才能熟練; 凡事唯有不煩,結果才能不凡。

能與智者同行,你會不同凡響; 能與高人為伍,你能登上巔峰。

你雖不能改變環境,但卻可以轉換心境;你雖不能樣樣勝利,但卻可以事事盡力。

Dr. Chao Yuang Shiang (PH.D in management), Assistant professor,Dep.of Finance,Nanhua University,Taiwan.

website:amazon.com/author/drchao |

|

新浪微博

新浪微博 QQ空间

QQ空间 人人网

人人网 腾讯微博

腾讯微博 Facebook

Facebook Google+

Google+ Plurk

Plurk Twitter

Twitter Line

Line